Chasing a mega China business deal from abroad will fail

Written by Chris DeAngelis

08/24/2020

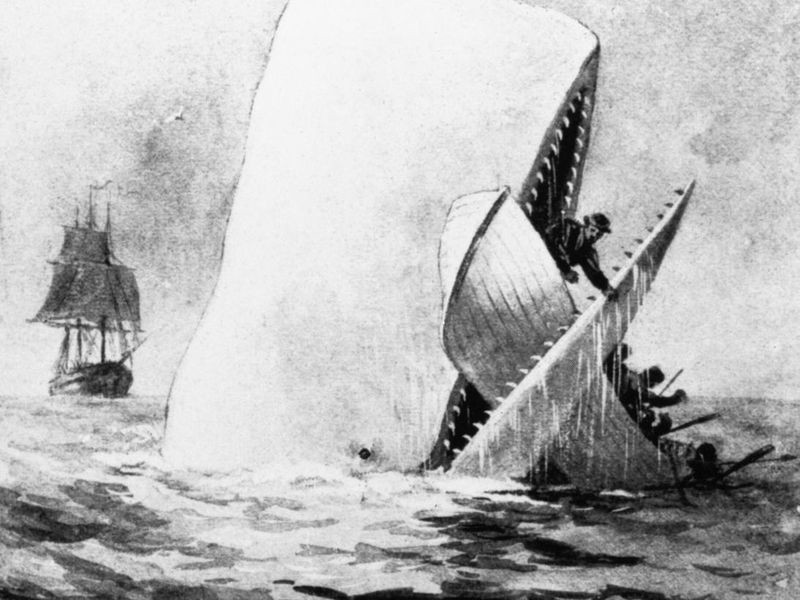

The white whale of trying to close a China business deal from afar. We endlessly see Western technology executives lose sound judgement and spend a year or more chasing gigantic deals with state owned enterprises (SOEs) or other public companies for large, highly competitive projects. For a number of reasons, this will never work out. Here is how it generally happens.

An enterprise software company that doesn’t have a presence in China is approached by a large China company, usually at a trade show or through their board’s network. A high-level executive at the public company is impressed by the technology and assigns a resource to investigate and pursue cooperation. The Western company sees only green (or red in this case). After a number of emails they get very excited and mark the public company as a top prospect and their gateway into the China market.

A year later — after having spent an untold amount on free trials, sales time and frequent trips to China — they are convinced that a deal is just around the corner. But it’s not.

How a China business deal generally goes (and shouldn’t)

We have seen this time and again, and in practice the real story is as follows:

The SOE executive was genuinely interested in the technology, and he passed it onto his R&D team to take a look. His team was excited to meet the company and learn about a technology that they only previously read about. The R&D team gets trials, meets with the Western company, and learns everything they need to know about what the technology does. They have accomplished their goal — from the Chinese company’s perspective that is the end of the story.

Why? Well, the problem is that in most cases, unless there is a compelling reason championed by a business person, the technology will never leave the R&D department. In reality, there might be an excellent use case, but if it is not a perfect fit then R&D will typically not be able to suggest deployment.

However, the Western company does not understand that this is the end of the line. Thinking that the deal is still near completion, they continue pinging the Chinese company, offering suggestions, and trying to push the project forward. Out of respect to a foreign company that is showing them so much “face,” the R&D team continues to communicate and share ideas and look for projects together.

After nothing happens, the Western company gets frustrated and flies its executives out to China thinking they can close the deal that way. They are usually treated well, taken to dinner, and some Chinese executives will come in and say some pleasant words about how they hope they can find a way to work together. Or in other cases, the key executives will suddenly have a last-minute emergency and send a replacement. Obviously, this is not a good sign.

Where ADG comes in

This is usually the point of the process in the China business deal where ADG is engaged. After an assessment and speaking directly to our contacts at both the Chinese company and in our partner network, we’re usually forced to come to the conclusion that there is no real traction for a deal (much to the surprise of the Western company). In some cases the barrier to a deal may be issues related to the business model or other issues that the Chinese company thought were not possible to resolve (and was uncomfortable bringing them up with a Western company). However, in many cases, there was never any intention on the part of the Chinese company to make a purchase.

In the end, the Chinese company will not take either a political or business risk to be an early customer of a company that has not fully committed and invested in the China market. This is especially true in today’s world if you are an American or European company. While most Chinese companies have good intentions, a China business deal is highly tied to personal networks, and if you don’t have a presence in China, your company simply does not have a network. Also, many deals at public companies have some level of government involvement in the background, which is another barrier for Western companies trying to do direct sales.

China is a unique market, and Western technology companies can rarely close major deals from outside of the country. In the vast majority of cases, they need an experienced and dedicated team on the ground inside of China to even close their first China business deal, never mind to work towards long-term growth and success. So, don’t be Ahab: do it right and build from the ground up in China.