China smartphone OEM strategy: Getting a foothold

Written by Chris DeAngelis

10/20/2020

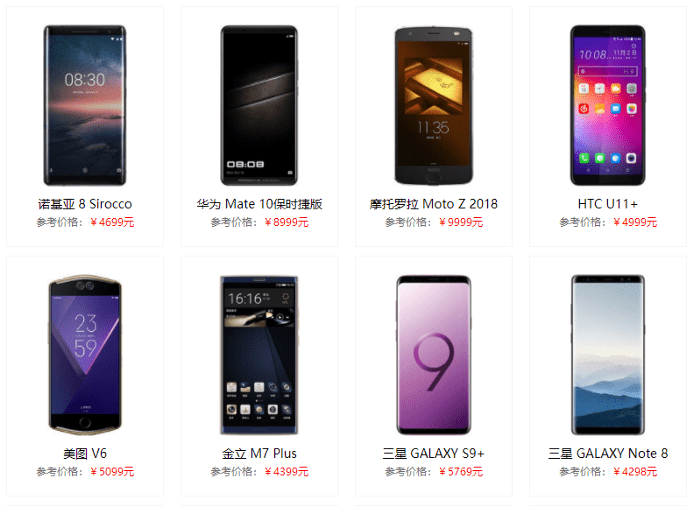

With over 870 million smartphone users* (which is still only 60% of the population) China continues to be a very attractive market for Western technology companies, from distribution to integrations. However, it is also one of the most competitive and dynamic smartphone markets. Western companies need to be realistic and adaptive to have a chance for success when working with a single China smartphone OEM or many at once.

We’ve worked on dozens of China smartphone OEM engagements for Western companies in China with our Sales Accelerator program. Having built strong relationships with nearly all smartphone OEMs in China, we wanted to share some advice on what your company should be prepared to offer to get them interested and eventually committed to your product or service:

You need to prove that you are worth the risk to be on millions of devices

Pricing power is straight forward if you understand your real value

In order to get the most out of your China opportunity, you need to make sure that both you and your OEM targets understand what you are bringing to the table. In general, most Western companies’ solutions fall into one of the following four categories:

- Must haves — Very few products fit this world. Typically, these are solutions around batteries, screens and camera technologies. If your technology brings users to the China smartphone OEM, you can earn healthy revenues.

- Marketing story — OEMs may use your solution to demonstrate innovation at their latest event or launch. You can earn some revenue, but only if your product can go beyond a few devices to mass market.

- Nice to haves — A cool feature or alternative to something in the market. You need to be easy to work with and offer a very attractive price. Even so, in China it’s nearly impossible to build a profitable business around a “nice to have.”

- Unique technology — Technology, by itself without a clear demand or use case, is a dime-a-dozen. China isn’t the right market for your solution unless you can invest the time and effort needed to develop it into something special that meets specific business needs.

Unless the China smartphone OEM CEO makes it happen (which is rare) you can expect consensus decision making

Above all, what you need to constantly remind yourself is that the best business cases and relationships usually win out in China. Along the way, you are going to need to convince a lot of people:

- Everyone can be a champion or a blocker, so always be selling and tell the high level story to every participant along the way.

- Everyone you meet will tell you they are the decision maker. It is often true but only for a very small aspect of the overall process.

- Don’t let your product get stuck in endless technical reviews. Unless you generate support from executives, product managers, planning departments, and local markets, you’re likely to end up in a never-ending cycle of review and analysis.

- Cross-department and multi-level lobbying & collaboration is necessary. This is due to the siloed nature of the China smartphone OEM organizations. Even your champions are unlikely to push above their bosses to bridge other decision makers and influencers. You need to do it yourself — and often for — the OEM teams.

OEMs are rarely experts and need lots of handholding — if they trust you, they will follow you

OEMs typically won’t have the same depth of experience that your team does, so help them get their overall product to the market — even for areas not directly related to you — and your efforts pay dividends in the future.

When they look to test your products, tell them exactly what to test, and how to test, being sure your strengths shine — many OEMs are truly trying to understand your solutions and their strengths, and many people want your product to pass these tests as much as you do.

Onsite support is required — but not like you think

The China smartphone sector is intensely competitive, and any bug, poor user experience or delay can cause major damage to the reputation of the China smartphone OEM. Local vendors (and successful global vendors) all provide local China support and you’ll be expected to do the same:

- Offering support from outside of China often runs into problems with China’s Great Firewall: there may be slow or highly controlled access to the Internet; an inability to send / receive large files; blocked USB ports… you get the idea. So if you are supporting from abroad, expect everything to take longer than it normally would, with a lot of back and forth communications to even get started.

- OEMs don’t need your best team onsite, and even so, they are only needed during critical times.

- One of the key roles is to be there when something goes wrong. That said, your team doesn’t necessarily need to have the skills to solve the problem. They just need to be there as a representative to hear the issues and make sure it gets addressed.

Reliability is everything for a China smartphone OEM

When discussions become serious on real projects, you need to be straightforward on what is real and possible. Respond quickly and work with OEMs to solve problems. This is even more important than having a perfect product.

Don’t believe everything they tell you and don’t give up

Many times a “no” or news of losing to the competitor is just the beginning of the discussions:

- At least 50% of ADG China’s wins started with finding out we lost. If you feel you should have won, you need to fight hard to explain your technology, get new evaluators and find out where are the real blockers to getting the deal done.

- There can be games played in China, and complaining to higher-ups can sometimes bring them out and reverse poor decisions.

- If you have the right relationship, people will generally be open and honest with you about you about what is really happening.

- There is often time to change your position, pricing, tweak the technology, etc. If it results in a better outcome for them, they will work with you towards a win.

- If you are persistent, then they know you’re the type of long-term partner they want to work with.

(*China smartphone users source)