How one global software company adjusted its China order processing and pricing to drive local orders

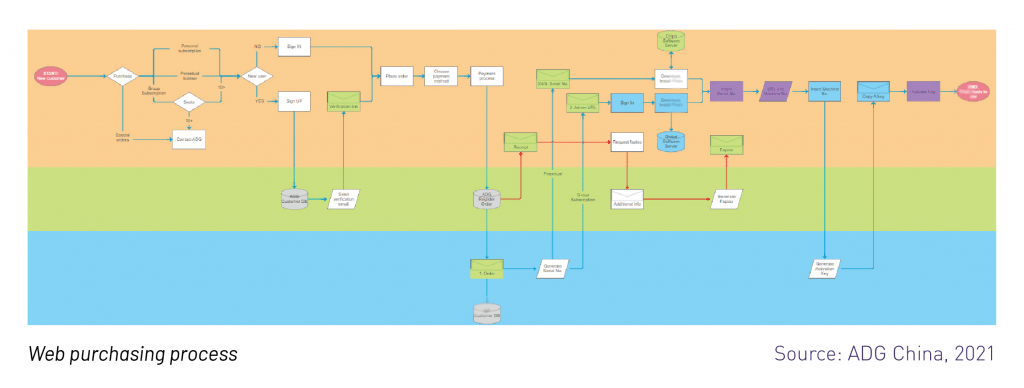

In our new whitepaper entitled, “How a Western Software Company Overcame Piracy to Thrive in China,” we detail how a US software company had been doing China order processing from its global website for years, with most of those purchases being inbound sales from resellers, individuals or enterprise employees that had access to international credit cards. However, for many larger enterprise prospects, prior to mid-2020 the company’s lack of a local Chinese website or local China order processing support limited the type and size of customers that could purchase directly from its global website.

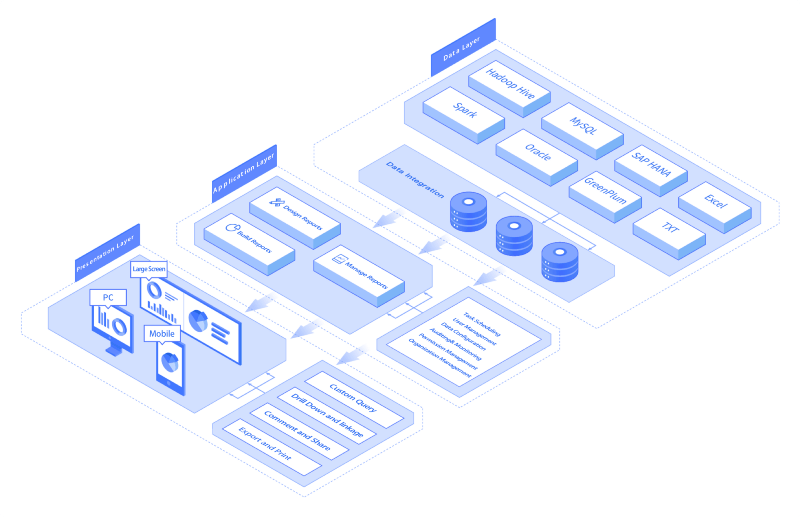

To make its China order processing easier, ADG helped the company to setup a local bank account under the ADG legal entity and began accepting local transactions. In mid-2020, ADG acquired a “.cn” domain under its legal entity and worked with the company to build and launch a basic online e-commerce website. This allowed the company to accept local payment methods, pay local taxes and issue official tax receipts to customers and resellers. On the backend, ADG managed cross-border payments and processed VAT to import the products into the China market.

China is not always a place you need to discount your product

One of the most interesting learnings was around overall pricing levels. Most companies believe that, in order to compete in China, they need to offer lower pricing. “In the early stages, we were debating at ADG and with the client on the appropriate strategy to address a pair of issues,” said ADG’s Chris DeAngelis. “First, we wanted to find additional margin to incentivize the resellers who already were losing margin on cross-border costs and were only receiving relatively small discounts. Second, the China platform run by ADG was technically and legally separate from the global website and required manual processing of orders,” continued DeAngelis.

In response, ADG proposed an unusual solution: to raise the list price in China higher than its global price in order to offset some of the cross-border expenses. The thinking behind this was:

- This would drive price-sensitive users to the global website, thereby reducing the amount of processing done in China

- Provide a higher list price inside China to provide local resellers extra room to gain margin

It worked beyond expectations by accomplishing both initial goals of attracting new resellers, while also increasing direct sales on the global website. An additional – and unexpected – bonus was that direct sales in China dramatically increased, and by early 2021 China direct sales processed at the .cn website in China outpaced and overtook the .com global website!