FanRuan, leading China business intelligence SaaS provider

Written by Chad Catacchio

07/15/2020

China is now considered one of the top markets worldwide for both business intelligence (BI) and data analytics providers. In China, artificial intelligence and machine learning are widely incorporated into BI solutions. Data sources in China are becoming more diverse and complex, and the number of BI users in enterprises has steadily risen over the last few years, with the telecom, finance and insurance sectors accounting for 82% of users nationwide.

While a number of global SaaS providers combine to form a majority of the adoption in China, the current leader is FanRuan, with roughly 15% of the market. Let’s take a closer look at FanRuan.

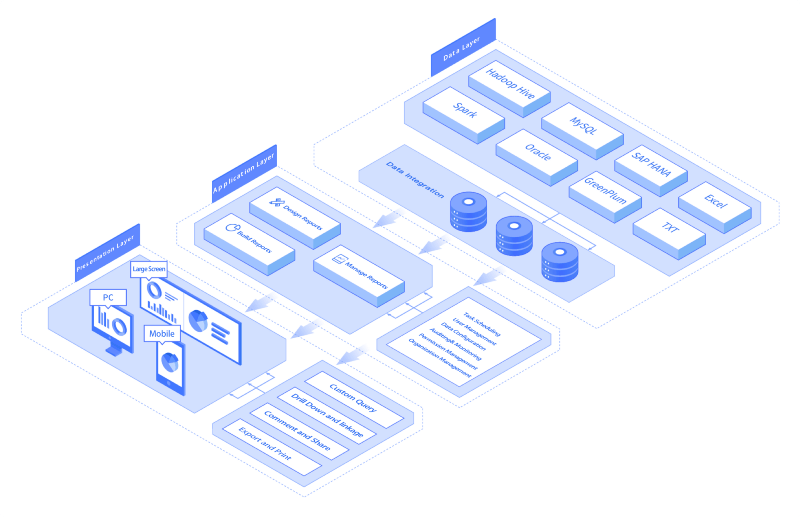

FanRuan (also known as FineReport, here’s its English website) has over 8,400 customers, serving some of the largest state-owned and public enterprises in China, including the Bank of China, Huawei and Wanda. The company reported revenue of US$94 million in 2019, and has global ambitions.

One of FanRuan’s strengths is in visualization and reporting on all form factors, from mobile devices to large wall displays, built using HTML5.

ADG’s Take on FanRuan

Like a number of companies working on big data, FanRuan has touted itself as a solution to analyze COVID-19 data (the pandemic has been seen as a driver of the sector in 2020).

While FanRuan has the most brand recognition and the largest service network of BI tools in China, its solutions fall behind a number of global providers in a few key ways: data preparation, modeling and spatial data analysis. What this means is that they are provide about 80% of a full feature set compared to global providers, but at a significantly lower price point.

As we mentioned above, while FanRuan has the most market share, it is the only Chinese company within the top 10 most used BI tools in China, and there is still strong opportunity for other Western BI providers to enter and succeed in the market, especially working with the right channel partners. We have been working closely with these partners for a global client in 2020, and we continue to have frequent discussions with a variety of players in this space, including FanRuan.